Portfolio

Border Adjustment Calculator

Simulates the effect of a border adjustment on a representative firm

Billionaires on Medicaid

Estimates underlying Mark J. Warshawsky’s op-ed Billionaires on Medicaid

Business-Taxation

Evaluates the effects of business tax policy on federal tax revenue

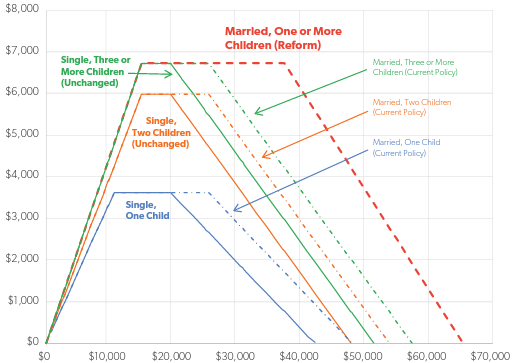

Child-Tax-Credit Webapp

Webapp for exploring the impact of Child Tax Credit reforms

Cost-of-Capital-Calculator

Evaluates the effect of US federal taxes on businesses' investment incentives

Cost-of-Capital-Calculator Webapp

Webapp interface for Cost-of-Capital-Calculator

CCC–Biden Webapp

Webapp interface for Cost-of-Capital-Calculator under Biden's tax policies

COVID-MCS

Web app implementing hypothesis testing methodology for COVID-19 case declines

C-TAM

Adjusts CPS data to account for under-reporting of welfare and transfer program benefits

EITC reforms

Simulates the effect of 4 EITC reforms to reduce single parenthood

Federal-State Tax Project

Modeling the impact of federal tax policy on the 50 states

OG-USA

Overlapping-generations model for evaluating fiscal policy in the US

Opioid Cost Model

Estimates state-level and county-level economic burdens of the opioid crisis

Paid Family Leave - Cost Model

Evaluates the total cost of paid family and medical leave policy proposals

ParamTools

Library for parameter processing and validation

Policy Change Index - China

"Reads" China's official newspaper - the People's Daily - and predicts policy changes

Policy-Engine -US

Designs tax and benefit reforms

Policy Simulation Library

Open source software library for public-policy decisionmaking

PUMA-descriptors

A collection of new geographic variables to be used with ACS data

Ranked Choice Voting in Alaska

Calculates alternative outcomes of Alaska’s August 2022 special election which used Ranked-Choice Voting to decide a winner

Synth-Impute

Library for data synthesis and imputation using parametric and nonparametric methods

Synthetic Household Data

Creates synthetic individual income tax dataset

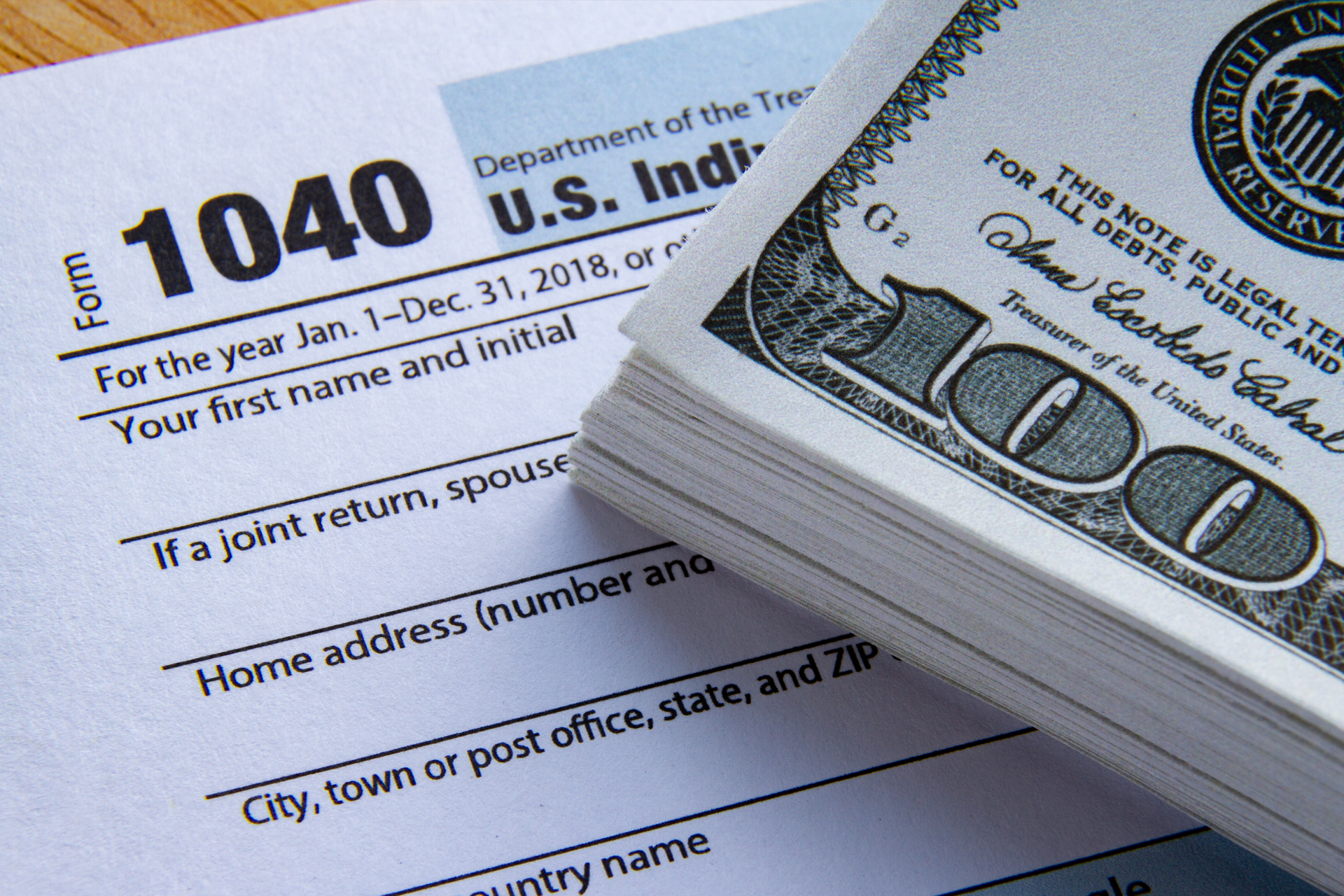

Tax-Brain

Integrator package and webapp for open source tax models

Tax-Calculator

USA federal individual income and payroll tax microsimulation model

Taxcalc-Payroll

USA federal individual payroll tax microsimulation model

Tax-Calculator: Behavioral-Responses

Estimates behavioral responses to changes in the US federal tax system

Tax-Cruncher

Calculates individual federal tax liabilities under customizable policy scenarios

Tax-Cruncher-ARP

Tax-Cruncher webapp for exploring impact of American Rescue Plan

Tax-Cruncher–Biden

Calculates individual federal tax liabilities under Biden's tax policies

Tax Data

Prepares data files used in Tax-Calculator

Taxes-Investment-Growth

Analyzes the effect of business tax legislation on investment, GDP, and wages

Unified Macroeconomic Projection Model

A Unified Long-run Macroeconomic Projection of Health Care Spending, the Federal Budget, and Benefit Programs

Vaccine-Efficacy

Replication code for assessing the efficacy of COVID-19 vaccines

Vaccine-Flow-Model

Replication code for modeling distribution of COVID-19 vaccines

Weighting

This package contains functions for weighting, reweighting, and constructing geographic weights for microdata